We can’t control investment markets but we can control how we react to them. Are you the kind of investor who tries to pick the best time to sell because you think you know what’s around the corner?

Or do you like to sit back and wait for the market to show signs of a recovery before you re-invest your money as you think this reduces your risk? Unfortunately, taking this approach is more risky!

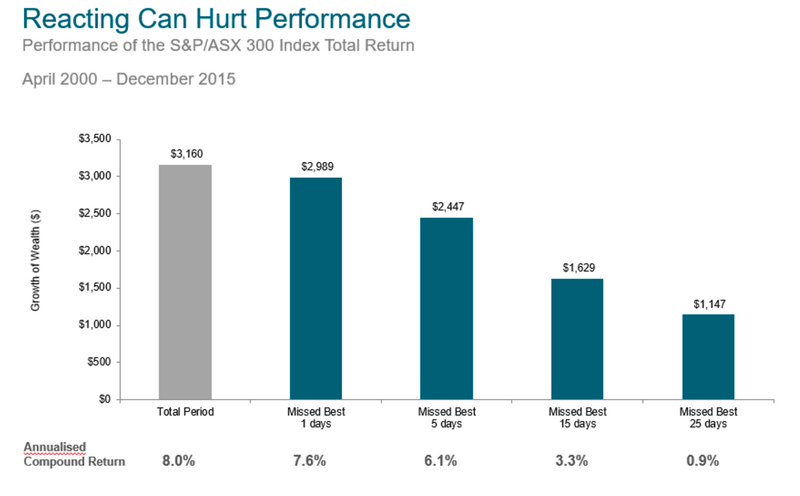

But don’t just take my word for it; here are the numbers for the S&P/ASX 300 (Australian Share Market) between April 2000 and December 2015:

As you can see, if during this period of approximately 3,700 business days you missed the ‘best 15 days’ (only 0.40% of the time) your annualised return would’ve plummeted from 8.0% p.a. to 3.3% p.a. compared to if you had just remained in the market.

To put that into perspective, you would’ve been better just putting your funds into a term deposit or bank account over this period. So clearly, staying the course can be much better for your investments over the long-term. But let’s not just look at meaningless percentages, what does this mean in real terms for you? Well, assuming you started with an investment of $100,000 this would’ve grown to $316,000 if you just invested in April 2000 and sold in December 2015 (i.e. stayed disciplined). But if you let that media ‘expert’ get the better of you and you missed the best 15 days of performance you would only have $163,000. That’s a loss of $153,000! That could’ve been a deposit on your dream holiday home or the funding for an annual overseas trip each year in retirement.Of course, we all have 20/20 vision in hindsight so it’s easy for me to say this now that we are ‘after the fact’.

Further to that, it can be hard to resist acting on the advice of that convincing mate we all have or the ‘investment guru’ who is on television each week. But if what they (and many others) are saying is really true, why would they be telling you? With the speed that information travels these days, how could anyone be so special that they have this information when the market doesn’t already?

My advice, just avoid timing the market completely and employ a disciplined, academically proven approach to your investing because sometimes staying disciplined (or doing nothing) is the best choice of all.