Happy Halloween!

I must admit, I never really got the point of Halloween growing up. Maybe it’s because when I was young the internet was still fairly new and the influence of the US on our culture wasn’t as great as it is now. Or maybe it’s because there was only so much chocolate I was allowed to eat on a weekly basis…! Either way, seeing my friends / colleagues children all dressed up in costume, having the time of their lives really brings a smile to my face.

It’s ironic (in a nerdy kind of way) that markets around the world have also had a pretty ‘spooky’ time of it lately. For the month of October alone, stock markets were down anywhere between 5% to 7%, depending on where you were looking. It’s a large drop, no doubt. And if you read the headlines in the media you would think the world is ending and we were about to be overrun by flesh eating zombies!

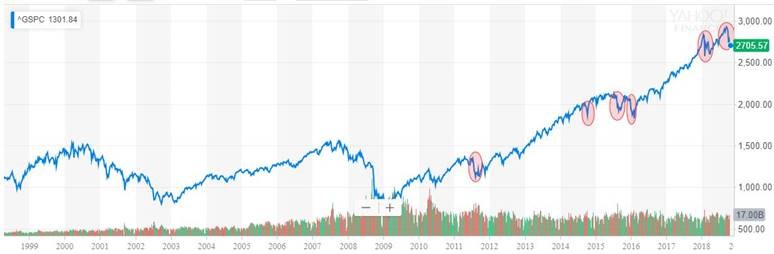

Before you go off and build a panic room however, here’s a longer-term perspective of the US stock market (S&P500). I’ve highlighted the most recent decline as well as similar declines we’ve seen over the last few years:

A market ‘correction’ is one of the greatest financial gifts that may be offered to you, but only if you accept it. What do I mean by that? It is only rewarding if you do something about it, that is, if you continue to invest – because you’re buying assets at a lower price. It gives you the opportunity to leapfrog your wealth in such a short-period of time.

This is what a Black Friday sale looks like in the US. For those of you who don’t know, Black Friday is basically the first day of the Christmas shopping season, and everything is ridiculously cheap.

Here’s what folk do when the stock market is ridiculously cheap.

Bizarre right? We aren’t wired to accept losses, we can get emotional as human beings and this is when people often make the worst possible financial decision. To sell!

The good news is that this has happened before, and as long as you have a long term plan you can stick to you will be able to ride out this short term pain. It is one of the trade-offs when investing in the stock market – you experience short term losses in exchange for healthy, long term gains. The top 100 stocks in the ASX between 2011 and 2018 are up 11.49% per annum and over 10 years are up 7.92% per annum. This is the compensation you receive for staying calm during periods of short term losses.

So is it time to start panicking? Far from it! Now is the most important time to stick to your long term plan and don’t let yourself be ‘spooked’ by what the mainstream financial media want you to believe.

Or failing that, at least there will be plenty of chocolate on sale today at the supermarket!